57 out of 12,333: An OTC Journey; A Couple of Names

I recently spent some time combing through the OTC market. It’s a pretty daunting place to look for stocks. Not only is information scarce but the sheer number of companies is overwhelming. Not a lot of investment funds can invest on the OTC exchange and the SEC made the purchase of Expert Market stocks extremely prohibitive a few years ago where only a select few brokers can even transact in the names.

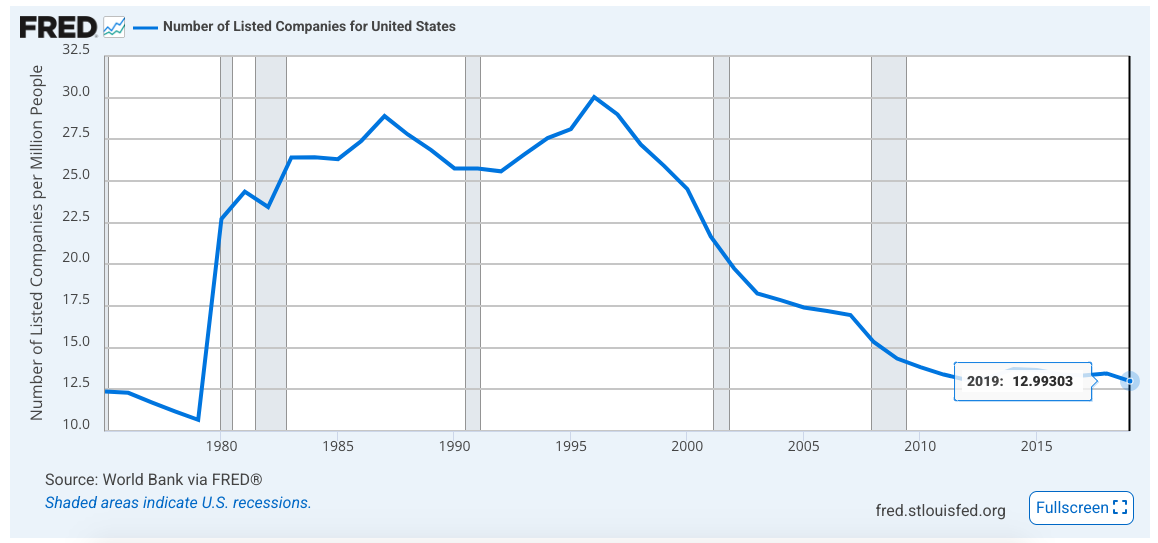

According to data from FRED, there are approximately 13,000 listed securities in the US, down from 30,000 in the 90’s. However, I’m not sure how accurate that number is.

Research Process

When I went to to the OTC website and clicked stock screener there were about 12,366 OTC securities. A huge number of potential investments but they also include a lot of international listed stocks.

While you do have the option of running a screen, some OTC companies don’t release financials so some of the companies won’t even be on there. Also, I never know if a screen will pick up every security so I don’t usually trust them as the ones that fly under the radar are usually the interesting ones. One thing I noticed is that the securities on the OTC page don’t list any “expert market” stocks (one of the tiers on the OTC). For that I had to go to FINRA and download another set of securities that had 50 listings per page and the document was 619 pages. That’s a lot of securities.

So now I had all the 12,366 OTC securities without the expert market stocks and all 31,000 securities which included the Nasdaq (2,800 companies), NYSE (4,205 companies) the OTC (12,000) and in the remainder spread throughout were the expert and grey market securities.

The problem was I now had two huge data sets with a ton of stock overlap on both sets. Sifting each OTC listing, while trying not to miss an expert market stock, I’d have to comb each set of data and compare page by page, line by line and look for a company that isn’t included on the OTC initial data set. It was a pretty annoying process and I’m sure there must be an easier way so if anyone reading this has a better way, I’m all ears.

Once I figured out the listing of the securities, I went through each one. A lot of them got an easy pass within the first 30 seconds once I saw the financial statements.

No revenues, lots of share issuances, liabilities > assets, unprofitable, poor quality business or just no real business at all. The international stocks I didn’t bother going through as I’ll look at those companies when I get to their exchange.

There were a TON of small banks that were all roughly fairly valued at 10x earnings and 1x book value.

It wasn’t all bad though. In there were some unique, profitable businesses with strong balance sheets that for whatever reason choose to remain listed OTC. These companies made it past the first 30 seconds and I would usually read their annual report and add them to my watchlist.

By my count, I added 57 companies that I can put on my watchlist out of a possible 12,333.

57 / 12,333 = 0.46%

While some of that 57 includes some expert market listings and some in that 12,333 doesn’t include the expert market listings, you get the picture. The percentage of finding something interesting is very low compared to the number of companies thrown at you. It’s a numbers game.

One of my favourites in terms of whacky stocks that I came across was the Rochester Community Baseball Inc. which is a AAA minor league baseball team that trades on the expert market. I’m not even sure you can buy it to be honest. The team is an affiliate of the Washington Nationals of the MLB and there was a good article a few years ago outlining their revenue sources which totalled over $10m. I thought about trying to ask around for some financials or shareholders and buying a stake as I don’t live very far from there, but I don’t think I’d be able to turn them into the next Savannah Bananas.

I also found:

An over 100 year old news paper company that has a market cap of $10m with about $3.3m in net cash, $3.6m of PP&E measured at historical cost that just did $1m in profit in 2025.

An educational company with a fast growing digital segment that pays out large dividends with 58% of its market cap in cash trading at 6x-7x free cash flow

A bank that just underwent a mutual conversion trading at roughly 50% of book.

2 Quick OTC Pitches

Q.E.P. Co. (QEPC)

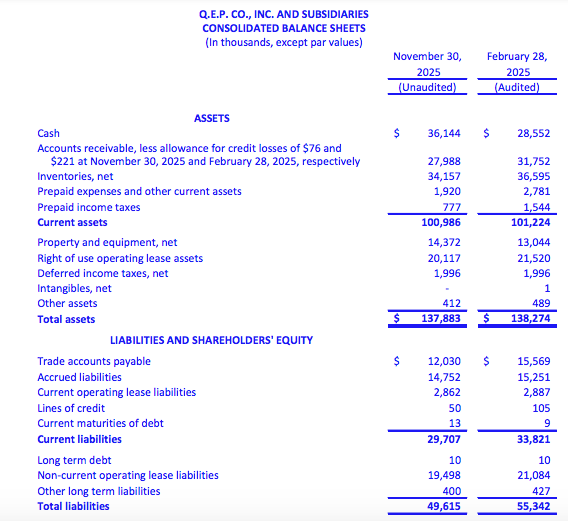

QEPC is a $130m market cap company that manufacturers tools and other accessories for the home improvement industry that are sold in home improvement retail locations (Home Depot for instance). In 2023 the founder, Lewis Gould, appointed his son, Leonard Gould, as CEO. Once appointed, Leonard got to work real quick. Although QEPC started selling some assets prior to Leonard’s hire, the new CEO took the divesting of assets into overdrive. QEPC sold a bunch of international operations which increased margins and the proceeds from the asset sales were used to pay down debt. Today the company has a relatively stable business with $36m in net cash for an enterprise value of $94m.

The divestments have shrunk the overall business but has turned it into a more profitable operation. I have the company doing about $20m in EBITDA for the year that’s about to end which puts it at 5x EV/EBITDA. Pretty cheap compared to peers at double or more the multiple.

The founder owns 50% of shares outstanding and liquidity is extremely low. Shares trade a few hundred a day and you’re lucky if a couple of thousand shares trade. With an 82 year old shareholder, these past couple years of “cleaning up the business” could be to position the company in the best financial light if they were to sell. The company would make a nice tuck-in to a larger competitor as most, if not all, of the executive positions could potentially be eliminated as 3 of the top executives make a combined $4.5m.

Westell Technologies, Inc. (WSTL)

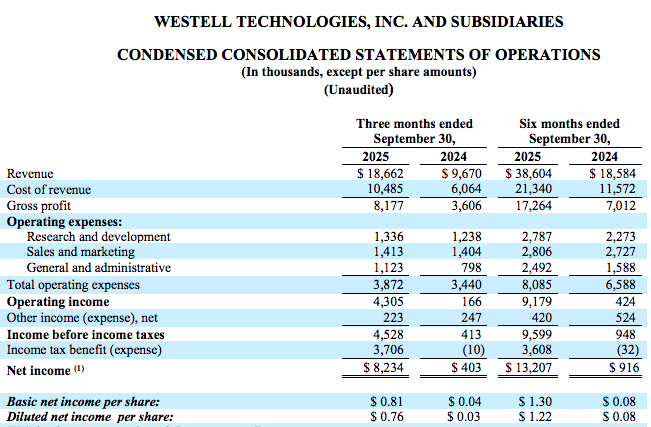

WSTL is another family controlled company that has also undergone a bit of a turnaround due to a change in management in 2019. The current CEO came in and has reduced the share count since by 31% (15.7m to 10.9m) and restored the company to profitability.

WSTL has a market cap of $66m and operates 3 segments:

In-Building Wireless (IBW) that provides DAS solutions to facilities that help first responders communicate in emergency situations.

Communication Network Solutions (CNS) sells outdoor network enclosures, fuse panels and other boxes and panels that serve the telecommunication and utility industry.

Intelligent Site Management (ISM) offers remote units that allow cell tower operators/utilities/etc. and others the ability to monitor their site remotely and therefore save on trips to the site if something is down or take preventative action to make sure everything is working as it should.

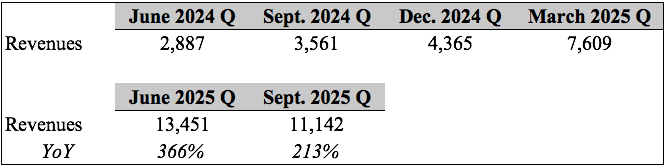

It’s really the ISM segment that makes this extremely interesting. In early 2024, the ISM segment started to grow extremely quick.

This has led to an explosion in earnings. In the first 6 months of their current fiscal year, they’ve earned $13.2m in profits when you give them credit for the release of a $3.8m valuation allowance compared to $916K in the first 6 months last year.. Taking this tax item out, it’s still $9.6m. Up 10x compared to the prior years first 6 months.

The balance sheet is extremely strong with no debt and $26.4m cash position which gives an enterprise value of $39.6m. There is roughly $20m in NOLs that can still be used up should the company continue its strong profitability and based off of the March 2025 backlog of $25m in just the ISM segment, seems like it should continue even though that number might stale. While it’s incredibly difficult to value a company that is growing quickly, using the numbers they just put up it trades at 2x -3x EV/EBIT, less than 3x earnings and 1.2x book without bringing the remaining NOLs on to the balance sheet.

What’s driving the growth in the segment? I don’t have a great answer to that as there are very little disclosures put out by management which is why it trades where it does and also why it is a smaller position for me. I’ve heard it could be from an increase in data centre monitoring to the BEAD program signed into law a couple years ago. Until I get a bit better understanding of 1) why the business has inflected and 2) if that growth is sustainable or not, it’s a smaller position for now.

New Idea: Beng Kuang Marine Ltd.

At 3x FCF with a repaired balance sheet and strong industry tailwinds makes Beng Kuang Marine an extremely compelling investment

Summary

Beng Kuang Marine Limited (BEZ.SI) has undergone a complete business transformation over the past few years brought about from the CEO hired in 2021. What was once an over indebted loss making company that operated in the shipping/oil and gas sector has monetized under-utilized assets, cut costs, paid down debt and entered into business lines that offer predictable recurring contracts. All of this has led to a business that has compounded revenues at 22% over the last 5 years and has allowed BEZ to turn a sustainable profit. Based on todays stock price and the markets uncertainty of a slow down in the business this year, I believe you can purchase BEZ at 3x FCF with a strong net cash balance sheet and an investment property that provides downside protection.

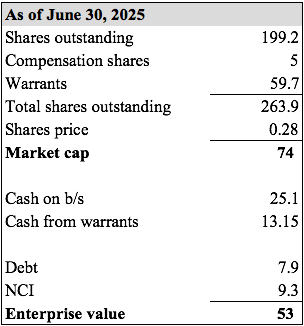

Capital Structure

Why’s it cheap?

Consistent losses. Up until recently their last profitable year was back in 2016 and they’ve had to take impairment charges over time on some of their assets due to the unpredictable nature of their former shipping segment.

Tied to the price of oil. Their business services the oil industry and if the oil price is down there’s less work for them to do on the vessels they work on as there will be less maintenance.

Trades on a foreign stock exchange. It trades on the Singapore Exchange and not many people are likely looking at a small cap Singapore company that operates ancillary to the oil industry.

Warrant overhang. BEZ issued a ton of warrants in September 2024 (30% of total shares outstanding at the time) at $0.22/share and are currently in the money that could be weighing on the stock.

Recent sales decline has the market worried. The stock has come off from it’s high of $.37/share as the market is unsure if the current revenue decline this year will continue going forward.

History

BEZ was founded in 1994 and has been listed on the Mainboard of the Singapore Exchange since 2004. Up until recently, it’s assets consisted of two warehouses, a shipping yard in Batam and a couple of vessels. Historically, it operated 4 divisions: Corrosion Prevention, Infrastructure Engineering, Supply & Distribution and Shipping. The shipping business consisted of some tug boats and as you would expect was not a very good business. The volatility in charter rates resulted in the shipping segment causing large losses in the consolidated financials.

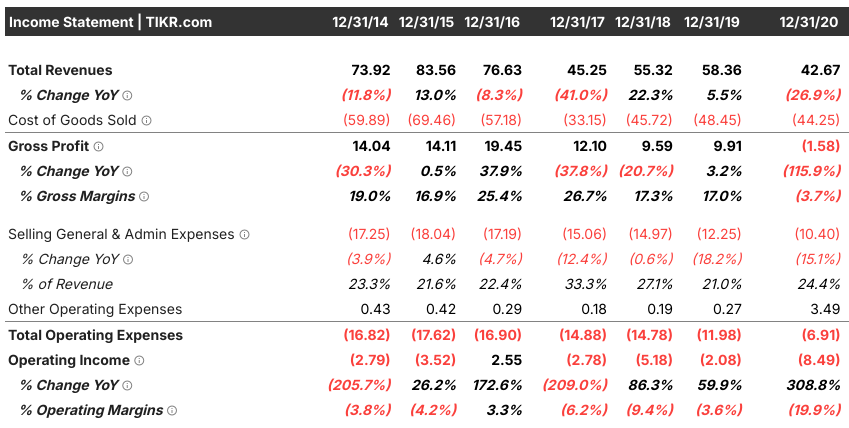

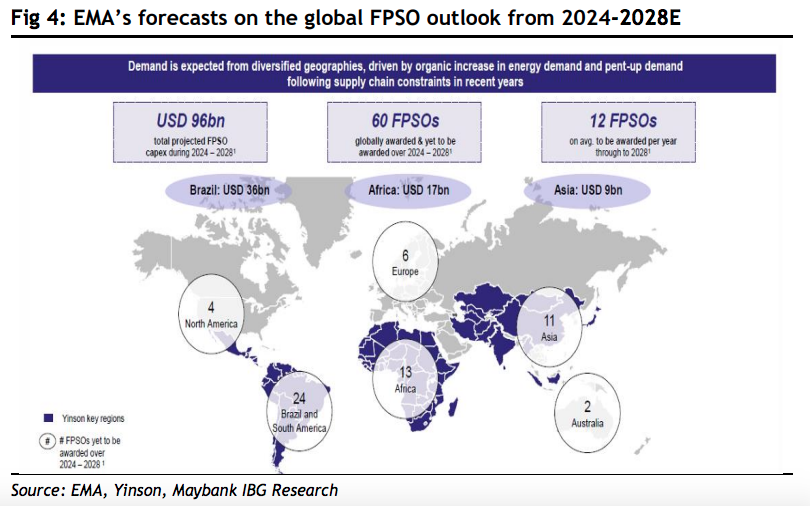

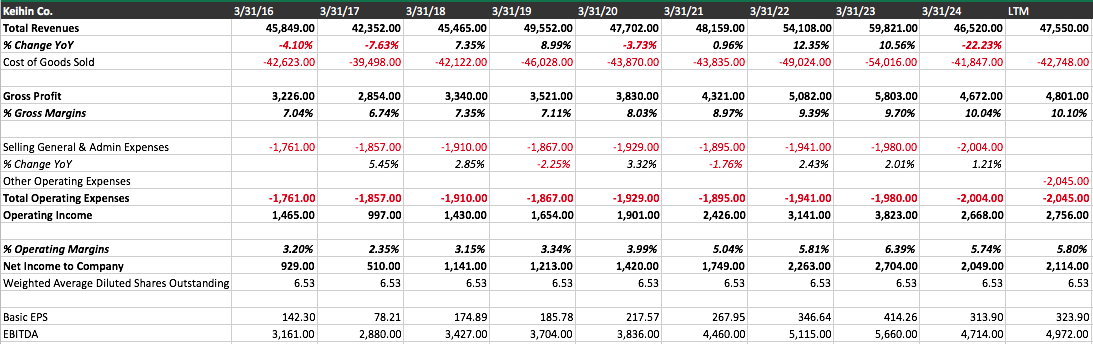

Looking at the income statement below, you can see revenues stagnant to declining from 2014 - 2020 and the company earning an operating profit in only one of those years.

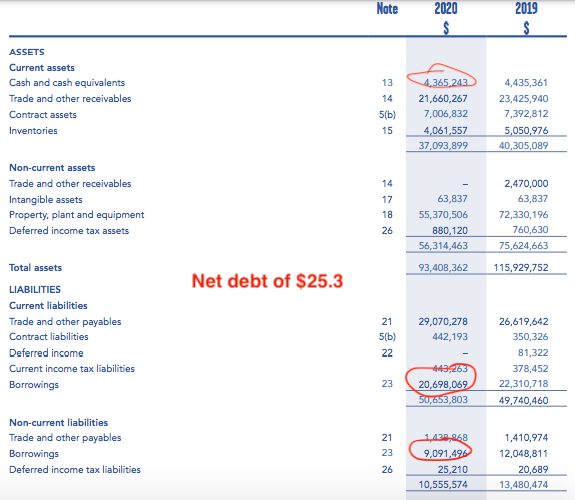

With the company losing money pretty consistently year after year, it had a large effect on the balance sheet. Going into COVID, BEZ had net debt of S$25.3m and PP&E made up nearly 60% of total assets. From a liquidity perspective, they weren’t in a good position as current liabilities were greater than their current assets.

It’s generally not a good idea to be over levered in a cyclical industry where you can’t maintain profitability. Any hiccup in the business can send you to bankruptcy.

BKM 2.0

In 2021, Beng hired Yong Jiunn Run as their new CEO. Yong spent his whole career in banking and was the former head of commercial banking of CIMB Singapore before he was let go during COVD. Upon taking the CEO job, he lent S$500,000 to the company in order to keep it going and initiated a strategic review. This strategic review was known as BKM 2.0 and it prioritized cutting costs, deleveraging, shutting down or winding down unprofitable business segments and pivoting toward a more asset lite/service oriented business model.

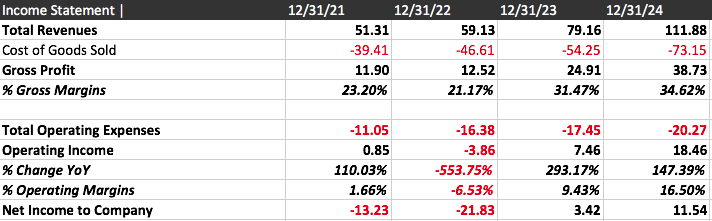

Over the past 4 years, the plan has been put into great affect. Going from a large net debt balance sheet with consistent operating losses to growing revenues quickly and expanding margins to finally turning a profit. Here’s just a few of the highlights:

Sold 2/3rd of their 32.8 hectares waterfront yard in Batam for S$19 million

Wound down the unprofitable shipping division and sold one of the tugboats for S$1 million

Gross margin has gone from low 20% to mid 30%

From the end of 2021 to the most recent released June 2025 balance sheet, debt has gone from $25.2m to $7.9m and cash has gone from $7m to $25m. That’s a net cash swing of $35.3m and net cash now sits at $17.1m.

PP&E is now 15% of total assets, showing the less capital intensive nature of their current operations.

The stock price has responded extremely well to these results, going from $0.03 - $0.04/share to where it sits now at $0.28/share.

Makeup of Beng Kuang Marine Today

Presently, BEZ is made up of two segments: their Infrastructure Engineering (“IE”) and Corrosive Prevention (“CP”) segment. Their IE segment offers a range of services to offshore vessels (FPSOs and FSOs) like maintaining and servicing the vessels, supplying customized deck cranes, life extension and conversion projects. Because these vessels are in harsh water environments, there is more wear and tear and therefore maintenance is required to ensure safety standards are maintained. They’ve gotten out of performing longer-term contracts that are more susceptible to delays and cancellations and focused on shorter-term contracts that turn over quicker but have predictable margins and offer greater stability.

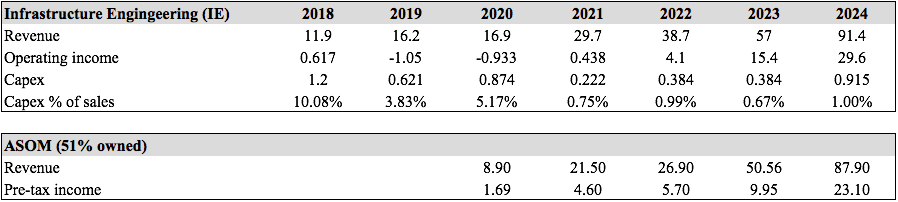

The gem of this segment is their 51% owned subsidiary Asian Sealand Offshore and Marine Pte Ltd (“ASOM”) that has been growing revenues and operating profits exponentially over the past 5 years. It focuses on optimizing and extending the life of these floating assets. This is what has been BEZ’s largest contributor to the overall growth recently. It’s owned in their IE segment and makes up pretty much all of their current revenues and profits. From 2020 to 2024 revenues have gone up 10x and pre-tax income 14x.

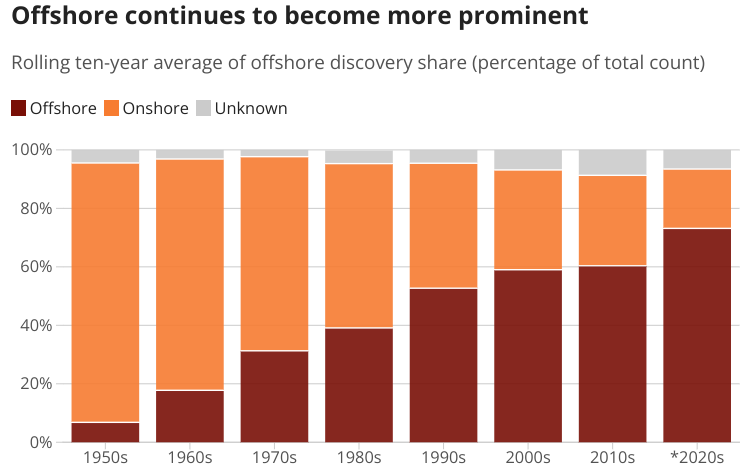

ASOM has been expanding their services to FPSOs all over the world from China, West Africa and South America which has caused this dramatic reverse in fortunes. As of last year, they serviced 24 of 186 FPSOs globally as they’ve expanded, which has allowed them to take market share. According to the CEO, once an FPSO uses your company, they will continue to seek your service because you understand what works and what doesn’t for that particular FPSO creating a sticky customer relationship. If you operate an FPSO/FSO, you don’t want to risk downtime by choosing a company who has no experience with your particular vessel.

Their CP segment provides an essential service in extending the life of vessels by removing corrosion. BEZ is the “Resident Contractor” in several shipyards in Singapore and Batam, Indonesia. It cleans the hull of the ships, removes any type of marine growth and applies protective paint to the hull to help shield it from further corrosion. This division has been around for 30 years and the revenues are largely recurring

Industry

The offshore oil and gas industry are serviced by both FPSO’s (Floating, Production, Storage and Offloading) and FSO’s (Floating, storage and offloading) usually in deep or ultra deepwater fields. FPSO’s and FSO’s hold the oil drilled up from the sea reservoirs with the primary difference being that FPSO’s can separate the hydrocarbons on board into their different components (oil, gas, water) and FSO’s just store the crude oil without being able to process it until a tanker comes and takes it off their hands. The reason these vessels of the offshore industry exist is because the typical pipelines attached to onshore oil and gas sites can’t be replicated offshore due to the huge cost burden it would take or it physically can’t be done as a result of technical challenges.

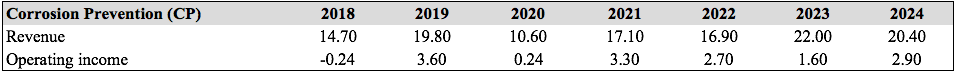

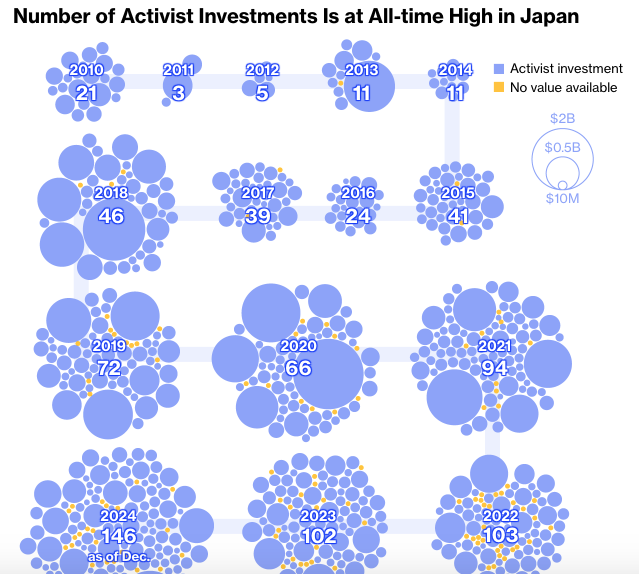

Right now there are roughly 180 FPSOs in operation all over the world and according to data put out a couple of years ago, more than half of the FPSOs are over 30 years old and a quarter are over 40 years old so there is clearly huge continuous demand for servicing these vessels and keeping them in service. However, the two key drivers of the industry right now that make an investment in BEZ potentially more interesting are 1) more and more oil discoveries are occurring offshore as evidenced by the below graph:

and 2) because of these new discoveries, there is a potential “golden age” of demand for FPSOs as over the next 4-5 years 60 - 66 FPSOs will be tendered, opening up the potential market size of vessels to service for BEZ.

Although the industry is clearly tied to the price of oil, the breakeven prices for drilling offshore, while incurring larger upfront expenses, are a lot lower than onshore breakeven. For instance, in the US Gulf, offshore b/e can be as low as $20/barrel vs onshore breakeven at around $48/barrel or higher. Talos Energy has stated that its offshore projects would remain economical even if global oil prices fall to $35/barrel.

According to Rystad, the cost of developing offshore deepwater fields has halved from $14/boe to $8/boe due to technological advancements (like equipment that can withstand higher sea pressures) and less people needed on board to manage the operations. These new advancements have also opened up more basins that can now be drilled.

Management

The company is run by the CEO Mr. Yong Jiunn Run who has shown that he’s an extremely capable CEO and has developed an impressive track record since joining. There are a couple of good interviews of the CEO out there on the web and in one of them he explains that being a former banker has helped him understand extremely well the benefit of having a strong balance sheet and conserving cash to create a cushion if the industry takes a downturn. This jives well with BEZ’s current net cash balance sheet. Although the CEO isn’t a top 20 shareholder, according to the annual report there is still strong shareholder alignment with the former chairman owning 4.5% of the co. and other insiders and members of the board owning another 16%. The COO is still one of the founders and his son runs the CP division and some of the COO’s brothers sit on the board who are shareholders.

Valuation

In 2025 BEZ sales and profit growth has reversed so far in the first 9 months of the year. Sales are down 11% to $77m, PBT is down 11% to $13.5m and EBITDA is down 8.5% to $16.75m but gross margins INCREASED 200 bps to 37.5%. Because they only own 51% of ASOM, some of these numbers are attributed to minority holders. The reason for the slowdown is due to delayed contract work in it’s African & Guyana operations. Although the work was delayed, it will eventually run through the numbers as it just shifts revenue timing. One thing to highlight that this turnaround is not just momentary in nature is the fact that in 2025 the price of oil has muddled between $60 - $70 and although revenues and profits are down, BEZ has still been able to maintain profitability. 5 or 6 years ago when oil reached these prices the company wasn’t profitable.

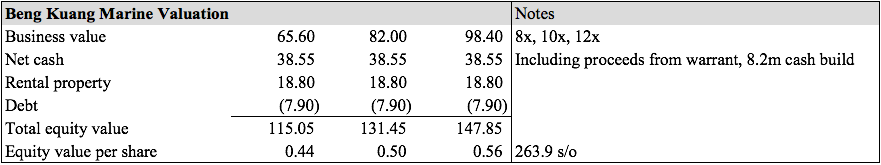

In 2024, after making adjustments for minority payouts and one time gains on sale of assets that went through the income statement, BEZ did about $13.4m in FCF. I don’t expect them to do as well in 2025 but looking out at 2026, any type of recovery in the IE segment could add further to the below numbers. Their CP segment has done/should do $2m-$3m in operating profit or $4m in EBITDA per year and these are recurring in nature. The IE segment did about $30m in EBITDA last year. Even projecting roughly $25m for 2026 for the total segment and a partial recovery, with only 51% of that going to BEZ, comes to $13m. In 2024 corporate overhead for the full year was $7m but so far in 1H 2025 they’ve been able to cut a good amount and annualized I’m projecting $5m. Adding these all up gets to $12m in EBITDA. Subtracting out $1m in capex, $1.8m in corporate tax (17% Singapore rate) and $1m in lease payments leaves you with FCF of $8.2m. An asset lite business with recurring contracts in an industry that has large potential tailwinds deserves a decent multiple and most Singapore comps in this space trade at 8x - 12x earnings (Dyna-Mac, Marco Polo Marine, Mermaid Maritime). Adding the surplus assets of net cash and a rental property they own and subtracting the current debt gives a range of 57% - 100% upside.

If you take the market cap of $74m at the beginning of this post, net out the $38.25m of cash and cash from warrants, add the $7.9m debt (don’t add the NCI because it’s already accounted for when calculating the EBITDA—>FCF) and net out the $19m rental property, true EV is approximately $25m. Right now the market is valuing BEZ at 3x FCF and the free cash flow should grow going forward.

Catalysts

Expansion into other services. BEX recently incorporated a subsidiary that will deal with specializing in industrial chemical cleaning that will be a future growth avenue depending on which segment or geography they wish to start from.

Price of oil goes up. Although offshore has low breakevens worldwide, the larger the gap between breakeven and the price to sell will result in more demand for offshore drilling and thereby BEZ services. The more vessels —> the more demand for servicing.

Intelligent use of excess cash. Management has told me that they are looking at using their cash for working capital and other growth initiatives. I have no problem with that as this team deserves a lot of credit for what they’ve done.

Risks

With BEZ being tied to the oil and gas industry, any further downturn in the price of oil can have a large affect on the future revenues and profitability of the company.

There is always the risk of management doing something unfavourable with the large net cash balance sheet but I think this team deserves a ton of leeway of what they would like to do with it.

More project delays. While project delays shift the revenue to future periods, it is one thing to keep an eye on.

Mestek Inc. Earnings Thoughts

Small update on Mestek’s recent earnings

Just a quick update. I wrote about Mestek in my Q3 letter and why I invested in it. The other day Mestek released their Q3 earnings and the stock was off roughly 7%. Only 1000 shares traded so no real conclusion can be gleaned from Mr. Market’s infinite wisdom on that day in my opinion. Looking at the earnings report, I was kind of shocked it was down and not up.

Using the most recent 10Q, this is what the enterprise value looks like:

This might be the cleanest balance sheet on the OTC exchange. Cash and investments exceed the market cap and after making the necessary enterprise value adjustments brings the EV down to $47.6m. Book value per share is $65/share so the company is trading at 75% of book value and just under NCAV. For a declining business this might be the right price. But Mestek is not a declining business and if you look at the recent income statement, these are the highlights:

Commodity income in the quarter was $16.5 million and for the 9 months in 2025 was $78.3 million. This drops straight to the bottom line.

Stripping out the volatile commodity income, Mestek generated $14 million in operating earnings just in the quarter. In the past 9 months, Mestek has earned $37 - $38 million in operating income. With an EV of $47m, it’s at almost 1x EV/EBIT in the trailing 9 months.

Sales have increased about 10% compared to the last year period and in the first 9 months sit at $313m vs the prior 9 months of 2024 of $291m. The company has grown and doesn’t seem like it’s declining. It’s a pretty consistent, stable business.

The company now generates more income from the commodity portfolio that was started 10 years ago than from their business operations that was started in the 1940’s. Levered commodity bets are a powerful force. I’m no lawyer or Investment Company Act expert, but this seems like it’s bordering on being classified as an Investment Company. About 40% of it’s assets (ST inv. and commodities) make up total assets and it’s income from commodity trading is starting to tower over it’s main operating business, which are some key tests that determine whether you meet the Investment Company regulations.

Just doing a rough back of the napkin valuation, if you annualize the prior 9 months EBIT of $37m you’ll get $50m for the full year. Take out capex of about $5m and using a 21% tax rate gets you to $35m in free cash flow. Just over 1x EV/FCF for a consistently profitable business.

Obviously there are risks with the company: the commodities portfolio is a bit of a black box and the large cash balance could be used to diworsify or never be returned to shareholders. But it’s hard to get to a “no” when it’s trading at this current price. The CEO has shown he’ll buy a business at the right price if it comes along so I don’t think making an unreasonable acquisition is a huge concern.

My favourite part of investing in Mestek is picturing the CEO trading the corporate commodity portfolio in complete isolation from the actual operations of the business from his massive mansion in West Chesterfield and absolutely crushing the market.

I remain long the stock and view it as an interesting way of playing the commodity renaissance taking place in the world today. You have a stable, profitable HVAC business with a smaller metal forming segment that has a large commodity portfolio attached to it that provides some significant downside protection.

Mayne Merger Arb Opportunity

A quick write up on a merger arb opportunity offering a 20% spread and a potential quick close

I’ve been following the Mayne-Cosette takeover battle in Australia from the sidelines but decided to enter the trade with the recent court win on October 15. I’ll invest in the rare merger arbitrage play if I feel the odds are extremely in my favour but most of the time the spreads are too tight or too wide for valid reasons. It doesn’t help that the downside is typically greater than the upside in most situations too. However, in this case there’s currently an approximately 20% spread due to two main hurdles outstanding that should be cleared within the next few weeks I believe.

Background

Back in February Mayne Pharma (listed on the ASX) agreed to be acquired by Cosette Pharmaceuticals for $7.40 all cash or AUD$672 million. A lot has happened since then and I won’t rehash all the details but just a quick background.

Mayne is headquartered in Australia but a large portion of it’s business is US based with a focus on dermatology and women’s health products. Cosette is jointly owned by a PE firm and a private market investment firm. It operates in the same two segments as Mayne: dermatology and women’s health. Pretty logical for why their two businesses should merge: same lines of business that can take out duplicative costs and obtain synergies.

However, Cosette claimed a MAC (Material Adverse Change) in May on 3 separate grounds of the SID (Scheme Implementation Deed):

The recently reported poor Q3 trading update by Mayne back in April (covering from Jan. – March)

The TMXD litigation against Mayne

An FDA ‘Untitled Letter’

The success rate of entering into a merger and than claiming a MAC to get out of the merger is borderline nonexistent. Even during COVID companies were compelled to complete the acquisition after claiming a MAC. What happened between February when the merger was agreed and May when Cosette was trying to claim a MAC were the Trump tariffs and the Pharma Executive order out of the White House. Essentially, Cosette got cold feet and tried backing out of the deal claiming a MAC on some rather bogus items. It looks like they just tried throwing some stuff out there to see if anything stuck.

Just to touch on their 3 MAC claims: regarding the Q3 weakness issue, there was an out in the SID if the annualized EBITDA declined greater than AUD$10.8 million but it didn’t appear that this was the case here as their Q3 performance was only temporary in nature and didn’t meet the necessary threshold on an annual basis which most likely saved Mayne here. Cosette was conducting due diligence during the beginning of the year in this time frame, did they not see the issue then?

The TMXD litigation is for a small amount relative to the size of the company (just over AUD$10 million) and I believe it started back in 2022. This litigation should have been known when conducting due diligence and accounted for. A weak ground to claim a MAC and in fact, Mayne is now countersuing TMXD.

Mayne received an FDA ‘Untitled Letter’ regarding one of its products that basically just said they have to remove some marketing that can be misleading to consumers. It was resolved in early June. Another baseless claim.

Where We Stand Today

While this was ongoing, Mayne sued Cosette to close the transaction and recently won. The stock trades around $6.17 for a decent spread and what I think is a high probability of closing. There are two last hurdles before the acquisition closes:

1) FIRB (Foreign Investment Review Board) Approval

FIRB is the governing body that scrutinizes Australian mergers from foreign investors and the threshold for when you need FIRB approval for non-sensitive sectors is $330 million.

Mayne has a manufacturing facility in Salisbury, Australia that provides contract manufacturing that employs 200 people. The Premier of South Australia wrote to FIRB asking them to block the deal in September because Cosette communicated to FIRB that they will be shutting the facility down if they completed the acquisition. This letter and attempt at using a politician to try and get out of a deal reminds me of when the French foreign minister requested LVMH that they should delay their Tiffany purchase (which ultimately closed).

Mayne has came back and said that Cosette is only saying they’ll shut down the plant in order to get out of the deal. They also say there is no business sense in shutting down the plant because it has a book value of just over $70m, the products aren’t heavily exposed to the US and it’s Australian segment has shown 7% revenue growth in the last year. Mayne also just spent $18m modernizing the plant.

The threat of just shutting down a plant with real value in the millions of dollars is illogical. It doesn’t make business sense to do so and is clearly a ploy to getting out of the deal. A plant that employs 200 people that is not tied to a critical or sensitive industry (defence, infrastructure, minerals, etc.) does not seem like there should be a logical reason for not giving an approval.

The FIRB decision is expected by October 31 (aka sometime this week) and I believe they’ll see through what Cosette is doing here.

2) Potential Cosette appeal of the lawsuit

With the court coming out in favour of Mayne on October 15 there is a 28 day window that Cosette can appeal, which would bring us to November 12th. However, the merger outside date is November 20 and the second court hearing to approve the scheme is November 3, 2025. That’s a lot of dates there and if you noticed the appeal date of November 12th is just 8 days before the November 20th outside date. Which would mean the appeals court would have 8 days to make a decision. However, I believe the courts would expedite the hearing in order to render a decision prior to the outside date. Justice Black’s opinion was delivered only 3 days after the hearings were finished.

Position Sizing

Because they downside here (30% - 50%) is greater than the upside, taking a smaller position to mitigate an unforeseen risk or something out of left field is crucial no matter how high the probability of close is here. If there was no downside and a high probability of close than the sizing would be different but for me this is a low single digit percentage of capital.

Gotham Partners Case Study

Gotham Partners made 83% in 6 months in an early investment but had they held on would have made 6x their money in 2 years

“We are primarily value investors” - Gotham Partners Investment Treatise

Back before Pershing Square was formed in 2004, Bill Ackman had started an investment partnership called Gotham Partners with his fellow business school grad, David Berkowitz.

The catalyst for forming Gotham was Seth Klarman’s “Margin of Safety” book. It wasn’t the typical current Pershing mantra of “predictable, cash flow generative, high quality businesses” but more deep value with a catalyst.

One of those deep value investments was Circa Pharmaceuticals that helped them get out of an initial drawdown.

Gotham Partners

Gotham opened it’s doors March 1, 1993 with only $3 million in AUM right out of Harvard Business School. One year later they would have 10x that amount as a result of being up 21% in their first 10 months. Initially both partners tried working full time jobs during the day and investing at night but that wasn’t going to cut it as they viewed this way as the riskier approach by not going all in.

They got their initial launch capital by cold-calling more than 100 members of the Forbes 400 list with only four ending up investing. They also created a 17-page “investment treatise” that was sent to potential investors. The document outlined everything:

their investment approach

the current state of the equity markets

how they view risk

their target partner

The first month of launching their fund got off to a bit of a rocky start:

One investment that helped them turn the fund around in the early days was Circa Pharmaceuticals.

The Hatch-Waxman Act

A little history of the generic pharma industry is needed first.

Before the early 1980’s, getting a generic drug to market proved to be too slow of a process because generic pharmaceutical companies had to:

Wait until the patent on a pharmaceutical expired before running tests. Any time prior to this would be patent infringement.

Once the patent expired and a company could run tests, the generic had to under go the same testing as if it was a brand new drug, running a full NDA (New Drug Application). Running an NDA is extremely costly and takes years.

The FDA had no fast track process or bioequivalence testing (what is now ANDAs) i.e., the generic had to run all the same tests the patented product did to prove it was bioequivalent.

Not only would a patented product get their usual exclusivity period, but they would also get the period from when the patent expired to when a generic was approved many years later.

The Hatch-Waxman Act was a piece of legislation passed in 1984 that fixed these problems by establishing the ANDA (Abbreviated New Drug Application) process and allowing bioequivlaence testing (meaning no new clinical trials typical of NDAs were needed). Because of this piece of legislation, generics went from 19% of the US prescription market back then to now 90%.

Incidentally the 1984 verdict in the court case of Circa Pharmaceuticals (formerly called Bolar Pharmaceuticals) is what caused a huge uproar in the US Congress that led to the Hatch-Waxman Act. I won’t bore you with the details but you can read about it here.

Circa Pharmaceuticals Scandal

Circa (formerly Bolar) was the largest generics drug manufacturer in the US, but once the Hatch-Waxman Act was passed, they decided to try to skirt around this new law as did many other generic companies.

In 1990, the FDA accused Circa of submitting false data in order to get approval for their generic drugs, primarly a hypertension drug called Dyazide. Dyazide was the generic industry’s top selling drug and from 1987 to 1990 it did $142 million in sales. By “submitting false data”, the FDA meant that Circa was literally taking the already approved patented pharmaceutical’s powder, putting them in Circa capsules and submitting it for bioequivalence. Then hiding, falsifying and destroying the records of doing so!

What came next were formal charges and indictments on most of the top level executives of Circa, including the CEO. Followed by a bunch of lawsuits, fines and jail time.

February 1991, UPI article

The FDA made Circa withdraw all of their current selling generic drugs from the market and they were prohibited from manufacturing or selling generics until the FDA deemed their manufacturing facility was in compliance. This affected 180 of Circa’s products. The FDA essentially froze their business for the time being.

To top it off, the CEO also admitted to price fixing this drug with their competitor, Vitarine Pharmaceuticals, to stifle competition.

The stock went from $50 to $4 between 1990 to 1993 as headline after headline kept the company in the spotlight and the large legal overhang weighed on the stock.

Summer 1993

Circa was the classic left-for-dead stock.

The CEO and other executives thrown in jail.

$78 million paid in fines over the past few years

The FDA in April just gave notice that it can manufacture and submit trials for new products again

The only real remaining legal issue outstanding was the price fixing scheme.

Gotham, after being down 3% in their first month of March 1993, started buying and paid as low as $4.12 and up to $6.25 for an average price of $5.18. They entered the investment some time in-between March 1993 and July 1993. I could only find a balance sheet for December 31, 1993 but it would have been approximately the same during the time of their purchase as the few million dollars paid in fines in November 1993 were offset by some shares forfeited back to the company by prior executives. Here’s a general overview of what Circa’s capitalization would have been:

And if you looked at the most recent March 1993 10Q or the past 3 years annual reports (1992-1990) it didn’t paint a pretty picture. The income statement was a mess, with fines, sales decreasing due to the FDA freeze and losses piling up.

In 1992, the company did $89,015 in total sales. Down 99% from two years prior.

But if you had dug a bit deeper, you would have seen there was value to be had.

Circa Valuation

Circa had an extremely strong balance sheet to make up for its lack of operations.

Cash and marketable securities totalled $51 million. They owned their own 161,500 square foot manufacturing facility in Copiague, New York that was worth roughly $25 million. They had a 50% JV interest with Mylan in Somerset Pharmaceuticals which produced a drug called Eldepryl that treated Parkinsons. Somerset was doing about $40 million a year in earnings and they were sending roughly $20 million of that in dividends to Circa. While the Eldepryl drug exclusivity expired in a few years, they were going to turn it into a patch to extend its life. Putting a 7x multiple on the potential extended earnings stream would value it at around $140 million.

They had some off balance sheet assets like a $71 million NOL. Tax affecting this at 35% would value it at $25 million. And they also had approximately 38 drugs in the pipeline that they could bring to market due to the FDA’s recent restriction lift.

On the liability side, they had legal reserves taken that were backed by securities held in a trust. Their only real form of debt was a JV liability (different from the Somerset JV above) of $15 million that was to be paid down based on the royalties now being earned on the drug in that specific JV. Summing it all up and this is what the underlying value was:

$10.18 was double the average purchase price Gotham bought it for. What gave investors pause was the uncertainty with regards to how much Circa would have to pay to settle their price fixing lawsuit. But there was a large margin of safety as anything less than a $100 million fine, based on my math, and investors would have come out ahead.

Outcome

Over the summer and into the fall of 1993, the price of Circa started rising as the market realized that the legal overhang was almost over as they were able to settle their price fixing lawsuit for just over a million dollars. In about October 1993 Gotham sold their shares for $9.47 getting an average return of 83%. Not bad for a few month holding period but based on what happened after they should have held on.

In 1994 Circa started getting some drug approvals and filing some ANDA’s and NDA’s while making other investments. The company's earnings increased substantially in 1994, reporting $17 million in net income or $0.80/share. So Gotham paid essentially 3x EV/FCF.

In 1995, Watson Pharmaceuticals bid $600 million, or $32/share. Had Gotham held they would have earned 6x their money in 2 years.

Even though they didn’t capture most of the price appreciation, they were able to claw back their initial 3% drawdown right out of the gate and finish the year up 21%.

Gotham Windown

Gotham would eventually have to liquidate their fund in the early 2000’s as a result of taking more illiquid bets while at the same time facing investor redemptions from the negative headlines of the MBIA Eliot Spitzer investigation.

They reached a peak AUM of $568 million in 2000 but then received $108 million in redemptions that year.

One of the more well known moments for Gotham was their 1995 plan to recap the Rockefeller Center Properties due to excessive debt via a rights offering vs the Sam Zell/Disney/GE group proposal with Goldman ultimately winning the bid for the property.

If you want a better understanding of why they were forced to wind down Gotham, there is a great article by Gretchen Morgenson from 2003 that I’ll include here that does it better than I could.

Update on Some Smaller Positions

An update on some of the smaller positions in the portfolio

I wrote a summary of some of the smaller positions in the portfolio in the recent Q3 2025 letter but thought I’d expand on some of them in a bit more detail here.

Citizens Bancshares Corp. (CZBS)

I originally wrote this up at the beginning of the year and it’s slightly down since that time period. Just to refresh, it has an $84 million market cap currently. For that price you get 1) $93 million in cash at the bank holding company:

and 2) a bank subsidiary that should spit out $10 - $15 million in earnings this year. It is one of the most overcapitalized banks in the US banking system, in my opinion, with all capital ratios in excess of 10%. Just a couple of key items from their annual report and Q1 earnings release:

In 2024 they repurchased $459,000 worth of shares compared to $7 million the prior year.

Their preferred dividends increased significantly, although off an extremely low base, to $1.27 million. Without this dividend they would have cleared EPS of $7, which puts the stock at around 7x adjusted trailing earnings. Instead they did EPS $6.5 in EPS in 2024.

BVPS is $36/share when you factor in the ECIP preferred. But if you value this preferred at where other banks have valued it in mergers at 28% of par value, adjusted BVPS comes in at $85/share vs a $47 stock price.

The company still has a large deposit cost advantage over many banks with the increase in rates the past couple of years. As recently as Q1 their deposit cost was 0.94% vs the average rate for smaller banks at1.81%. And many of the key banking ratios suggest that Citizens is an above average bank: Pre-tax return on assets greater than 2%, efficiency ratio of 57% and ROE, when eliminating preferred dividends and marking the preferred at market, of 13%.

They just announced a $4m share buyback (5% of shares) this year and increased their dividend by 10% to $1.10/share. Management is doing all the right things from a capital allocation perspective since they got the ECIP money 3 years ago. The problem with the stock is the extremely low liquidity in the shares that makes it nearly impossible to do a large buyback unless they do a tender offer. I still believe they’ll eventually do an acquisition but the management team needs to find the right deal which could take time.

I’m more than happy to continue owning this as it trades for about 7x earnings, a significant discount to adjusted book value and private market value (would most likely go for greater than 1x book value if sold) and a huge cash pile at the holding entity.

Tetragon Financial Group (TFG.AS, TFG.LN)

Not a huge update as the thesis remains the same but Tetragon has been hitting all time highs recently on the announcement of further Ripple buybacks and as the market somewhat awakens to Tetragon’s ownership in the company.

Ripple’s latest buy back is taking place at a $40 billion dollar valuation which means $250/share. In the private market place it’s marked at $137/share and Tetragon right now is marking their stake at $94/share. It’s currently their second largest holding.

As the price of Ripple has gone up and become a larger percentage of NAV, the stock price has had to follow it to maintain the roughly 50% - 55% historical discount to NAV. The new NAV is just over $40/share and TFG is at $19/share. If (hopefully when) Ripple IPO’s at a large valuation, Tetragon’s share price should follow it upwards. I continue to think the management team has a huge opportunity to buy in greatly discounted stock to increase the NAV that would accrue to themselves before that happens.

In the mean time the CEO of TFG Asset Management, Stephen Prince, has picked up over $5m in shares this summer. It’s a pretty large buy from an insider and I don’t need to remind everyone that insiders sell for many reasons but they usually buy for one.

Leons (LNF.TO)

Leon’s announced a great Q2 but still hasn’t given a specific timeline for their real estate IPO. A few Q2 highlights:

Adjusted earnings per share, when netting out the $7.6 million USD forward contract loss, was $0.57 for the quarter. This is a 30% YoY increase which was contributed by two main items: overall sales were up 4% to $644 million and gross margins expanded nearly 100 basis points from 43.9% to 44.82%.

The company continues to return profits to shareholders in the form of dividends and share buybacks. Their quarterly dividend was raised 20% from $0.2/share to $0.24/share and they’re in the process of buying back 5% of the company on the open market from March 2025 to March 2026. The buybacks so far have been negligible as they’ve only bought back 12,800 shares out of a possible 3,403,405 shares.

They still have a really strong balance sheet with net cash of $50 million after netting out debt and customer deposits as well as real estate marked at cost of $681 million on balance sheet vs ~$1.5 billion market value.

The key to the stock increasing from here, in my opinion, is a timeline of the IPO and then obviously the actual IPO. The TSX IPO market has been nonexistent these past few years. It’s had one IPO this year that was a New York luxury apartment REIT called GO Residential. The deal was oversubscribed and raised US$410 million and I’m hoping this opens up a path for Leon’s to consider taking their REIT to market.

Until there is more clarity on the IPO the stock may be range bound for a bit. One thing I am watching is for when they submit their Secondary Plan with the City of Toronto which is required to change the land use of their corporate headquarters and actually redevelop it. You can check at this link if they submitted and unless I missed it I still don’t see it there yet. The submission was to be done by 2H 2025 so we are a bit past that timeline now.

EDU Holdings Limited (EDU.AX)

I’ve never written EDU up but it had/has a lot of the hallmarks of a special situation I look for when I took a position:

Corporate change via a management buyout. Management wanted to buyout shareholders and delist the company because of burdensome listing fees, regulatory uncertainty and low liquidity.

Large insider purchases and buybacks leading up to the buyout

Earnings inflecting in their underlying business

At the time of the MBO offer in May, they also announced a 50% buyback of the shares (75m of 150m). The buyout was announced at $0.165/share or a $24m market cap and was subsequently dropped as shareholders pushed back on the timing and price of the buyout as you’ll see below.

EDU is an Australian for-profit education provider that provides it’s students certificates, diplomas and degrees and operates two divisions. They’ve suffered some losses the past few years due to COVID but earned record revenues and profits in 2024. Revenues were up nearly 100% to $42 million, operating income turned positive to $4.2 million and net income inflected positively as well to just under $3 million.

In 2022, Australia’s Skilled Priority List had 1) early childhood teachers, 2) child carers and 3) age and disability carers as 3 of the top 10 professions in critical shortage. At the same time, EDU decided to start a product development plan with course offerings going from 22 to 29 course offerings in 2024 targeting these professions.

It’s IKON division provides Higher Education (like Bachelor and Masters of Early Childhood Education amongst others) to both domestic students and international students. The increase in the international students in this division has been what’s driving the inflection as you can see from their 2024 annual report.

While domestic students has remained somewhat steady, the international student enrolments have gone gangbusters and has the majority of Ikon’s overall $28 million in revenue in 2024 as seen below. Ikon delivers longer student durations (2-4 years) due to the type of program offered and at higher tuition costs of approx. $19,000 - $48,000 making it more durable and predictable vs a certificate course lasting less than a year compared to EDU’s ALG division.

It’s ALG segment offers diplomas and certificates to international students in Mental Health, Counselling and other Vocational Education and while it grew revenues 43% from 23’ to 24’ ($9.3 million to $14.2 million), it finally flipped to profitably as of the June 30, 2025 1H results of $0.5 million. While it seems that this division will now add to profitability going forward, it’s a smaller part of the overall business.

The nature of EDU’s business has large operating leverage as it rents rooms in some of Australia’s major cities (or via online) and must pay the teachers no matter how many students are enrolled. If you have one student in the entire program, you still have to pay the fixed costs of the campus, student administrative costs and the business will operate at a loss. But if you have many students, the costs of the business stay relatively the same for each new incremental student that enrols and falls right to the bottom line. This leads to huge incremental margins as you’ll see below.

Since the attempted $0.16/share MBO was dropped the stock’s been on a tear up to just under $0.76/share as the CEO and other insiders have made large purchases, EDU has repurchased over 6 million shares (on top of the 9% of the shares repurchased in 2024) and enrolments and the underlying business have continued their torrid pace of growth.

In June they released that Ikon’s T2 25’ enrolments were up 118% to 3,725 students and YTD 2025 enrolments were up 132% to 6,967 student enrolments vs YTD 2024 2,996 enrolments.

And their first half results highlighted why management wanted to take it private. 1H 2025 revenues jumped over 100% to $36 million while the company netted a total $6.3 million with incremental EBITDA margins of 45%. The company completely transformed their balance sheet, adding $16 million in cash from both operations just in the first half of this year. Right now they are sitting on net cash of $21.2 million.

Based on just the first half results, insiders wanted to buy the company for 1x annualized EBITDA or 2x earnings. It was clearly worth a lot more and the stock has reacted as such when the bid was dropped, going up over 4 times the bid price.

Coming up with a valuation for a company where earnings have inflected and is growing very rapidly can be a bit of a challenge, not to mention the regulatory risk (see below) that is always lurking. But there is some comfort in the large net cash balance sheet and current business model where students in IKON are signed up for 3-4 year degrees allowing revenue to be more predictable.

With a share price of $0.78 and shares outstanding of 152.5 million (accounting for the share repurchases to date) puts the market cap at $119 million. Netting the $21.2 million in cash brings the enterprise value to $97.8 million. Management has stated that the 2nd half of 2025 will look like the first half so just annualizing this and adding $6 million in 2H net income to cash at year end would bring the enterprise value down to $91.8 million.

Meaning this would put EDU at 4x 2025 EV/EBITDA and 7x 2025 earnings. Because IKON makes up a larger part of the overall business and their degrees are 3 - 4 years long, their current run rate for 2026, without taking into account newly enrolled students, should be roughly the same as 2025. Based off of 2026 numbers and cash build up during the year would put EDU at 6x earnings and 4x EV/EBITDA. If you add in an expected growth rate of between 10% - 20% for new enrolments, it’s trading at 5x 2026 earnings and 3x 2026 EV/EBITDA. Clearly way too cheap for a company that just grew more than 100%, will have sustainable earnings going forward, a net cash balance sheet that is only growing and a company in the open market buying back stock aggressively.

This investment and business is not without its risks. There has been a push to bring down migration into Australia as the number of international students in Australia has gone from 474,493 in 2022 to more than 800,000 as of the end of 2024. The theory is that all of these international students have caused a housing affordability crisis with rents and house pricing in Australia ranked as the one of the most unaffordable place to live currently. By making it harder for students to obtain entry, the theory is it would free up homes and bring rents and pricing down to help abate the situation.

One way that’s been implemented is by increasing the nonrefundable VISA application fees from $710 to $2,000 and tightening entry conditions. Another way the Australian government proposed in 2024 was by capping the number of international student commencements at universities (essentially onshore student visa holders) with each school only getting certain allocations of the total cap.

This student capping legislation was scrapped but there’s still some uncertainty around the international student space and what the government will ultimately do. One of the reasons it was most likely scrapped is that not only does Australia have the second highest share of International students globally, but it contributed $51.5 billion to the economy last year, meaning it’s Australia’s 4th largest industry and the “biggest export we don’t dig out of the ground” according to Education Minister Jason Clare. Blowing this industry up would likely cause an Australian recession.

There is currently a target for 2025 of 270,000 commencements and it was raised to 295,000 for 2026 with the 2025 numbers looking like they’ll just be met. The Department of Education in Australia puts out monthly data on enrolments and commencements that allow you to track how each educational sector (VET, HE, etc.) is performing at this link. This regulatory risk is the biggest risk to the stock but the government seems to have turned the dial down on severe restrictions for now.

I came across this idea from Jeremy Raper (@puppyeh on twitter) and credit goes to him for being one of the first ones on the name.

Western Capital Resources Inc. (WRCS)

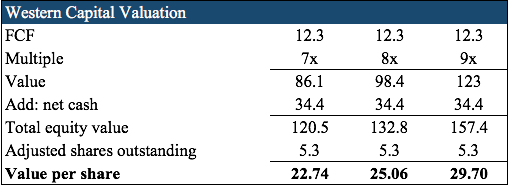

Not much has really changed since I wrote WRCS this summer (see here). It is highly illiquid and trades on the expert market so the vast majority of investors don’t have access to a broker to buy it or can’t look at something with such a low float. It trades at $14.50/share right now, a slight discount to where the company tendered in April at $15/share.

So far in 2025 WRCS has bought two arenas for a total of $10.3m with little cash down and a large percentage of the purchase price using favourable seller financing so their debt is up a bit but they still have $15m in net cash as of 2Q 2025. These purchases were disclosed in their annual report occurring after the December 31, 2024 financial period and their 1Q 2025 and 2Q 2025 don’t disclose if anything else was purchased, it’s just a set of financial statements.

I believe both purchases were from Black Bear Sports Group, which if you recall is owned by Murry Gunty, who is WRCS largest shareholder through a maze of LLCs. There seems to be a grey line between Black Bear and WRCS as not only is WCRS purchasing the arenas from Black Bear but Black Bear, at least for the April 1, 2025 purchase of the Chelsea, Michigan rink, even announced a press release on their own site in August about a sponsorship name change when they no longer owned the arena:

I’m not sure exactly what the ultimate outcome here is as the company keeps doing tender offers AND buying businesses within the holding company. One outcome could be more tenders until there is a potential merger squeeze out of minority shareholders. Another outcome could be to merge the two companies (WRCS and Black Bear). While another scenario could just be to continue as is: trade on the expert market, repurchase LLC interests over time and add ice rinks and other businesses to the holding corp. structure.

With a stock price of $14.5 and adjusted shares outstanding at 5.3m, the market cap is $77m. Subtracting net cash of $15.5m and adding NCI of $1.7m gives an enterprise value of $63 million. While I am not exactly sure how the losses and turnaround of their purchase of Northern Brewer is going currently, just annualizing their YTD numbers puts the business at 5x - 6x EV/EBIT. If there are still some losses at Northern Brewer, that could be weighing earnings down a bit as it lost $2.2 million in 2024. Raising that to zero or even to the point of profitability would eliminate the drag on earnings and value the overall business at between 3x - 4x EV/EBIT. I’ll have to wait for full year 2025 numbers to be sure and in the mean time I’ll be watching for further tender offers or nuggets of information I can find.

Idea Brunch With Edwin Dorsey

I was interviewed by Edwin Dorsey on his Sunday Morning Idea Brunch this past week. We talked a bit about my background and a couple of stocks I like at the moment.

You can read about it here but I think some of it might be behind a paywall. If you want the full PDF send me an email or I’ll see if I can attach a free PDF here later. Enjoy!

Edit: Here’s the full PDF

Case Study: Warwick Valley Telephone Company

One of the fastest growing companies hidden in a small, sleepy rural local exchange carrier

I came across this article from 2006 about Larry Goldstein (of Santa Monica Partners, or SMP) and his investment in Warwick Valley Telephone. I made some notes that I thought I’d share in the form of a case study at what made Warwick an interesting set up but ultimately not a successful investment. I like reading old writeups or articles to see what information was available at the time of an investment to see what the investor was seeing and think if I would have made the investment as well. It’s also a good way to screen for future investments based on the setups of the past and certain pattern recognition to look for.

I believe SMP owned this a few years prior to filing their first 13D but I’ll start with when the first 13D was filed at the end of 2003. From what I read the total size of the position for SMP was 1.7% (based on $160m fund size and $2.65m investment). Not huge, but I think he set a record for the number of 13D letters sent to a company.

Valuation

Warwick was a rural local exchange carrier (RLEC) in a few small towns in New York and New Jersey that was muddling along with a few million in profits. The stock had been owned by families in the Goshen, New York area and passed down generation to generation. Apparently the largest shareholder was an elderly lady who lived in Warwick too.

At first glance it doesn’t seem that appealing. On the surface it appeared expensive and more than fairly valued.

Equity Income > Operating Income

But if you look closely at the financials you’ll see they generated more money from their equity investments than their main RLEC business.

Flipping to the balance sheet, those equity investments that generated $8.3m in 2003 were carried at only $5.3m.

And going to the back of the annual report to Note 9, you’d see a breakdown of what these investments were.

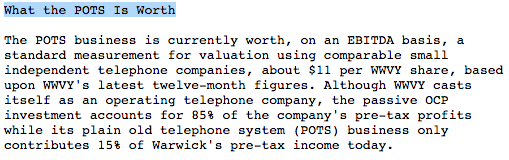

The O-P Partnership was a 7.5% joint venture in a Limited Partnership called Orange County-Poughkeepsie Limited Partnership (“OCP”) with Verizon that sold wireless minutes to larger telecoms that was hidden from the consolidated financials. Verizon owned a majority 85% of the partnership as a GP. How did a partnership investment carried at $3.7m throw off so much equity income?

Well when you read the disclosure of how the partnership was doing, this was what you would have seen:

For a better visualization, this would be the past few 5 years (excluding 04 and 05 at the time).

The partnership owned what seemed like one of the best businesses in the world: fast growth, huge margins and it barely needed any capital to operate or grow. Because the investment was accounted for using the equity method, you couldn’t see the valuable partnership investment unless you looked in the notes. Yes you could see some income from equity method affiliates, but you had to dig a bit further to grasp exactly what you were looking at. Anyone running a screen back then probably wouldn’t have picked up on this.

The OCP partnership even paid out the vast majority of their income to partners. The millions that were distributed to Warwick were essentially propping up the muddling RLEC business.

So they had an investment on the balance sheet marked at $3.7m that was likely worth many multiples of that and paying out millions of distributions. Yet SMP didn’t think it was being fully reflected in the stock price.

SMP First 13D

Santa Monica Partners filed their first 13D (the first of many) in late 2003 when the share price was $25.5 vs where they thought it should be at $39. They gave a list of 5 unique options that Warwick could do to highlight the underlying partnership value:

Here’s the full 13D filing. My favourite financial engineering option here is #1 because it’s pretty unique. I don’t think I’ve ever seen a company do that. Issuing a debt instrument backed by the distributions of the partnership stake to create over $100m in value.

The management team didn’t seem to think it was worth that much though as they had a valuation done the prior year. Their advisors only came up with $22.5m.

However, it would be the spinoff that SMP would argue for as detailed in a follow-up letter. By doing the spinoff, the new company would get the original Warwick RLEC business and the existing company would keep all the investments so it could pay out all of it’s income as dividends.

Management and the board refused to engage with SMP and discuss any of their ideas. They continued taking the partnership distributions and plowing them back into the RLEC, which continued it’s decline.

With an unwilling board SMP tried a different tactic.

Verizon Ploy

Remember Verizon owned 85% of the partnership. At the time, Verizon had $53B in debt and was looking at selling assets to pay some of that down. So SMP sent a letter to Verizon’s CEO outlining what they thought OCP could fetch in an IPO.

Based on their estimate, on the high end it could go for $3.8 billion and on the low end $1.5 billion. Verizon’s 75% proceeds would be $1.8B - $3.26 billion. SMP even asked for an investment banking finders fee if they proceeded with their plan.

I’m not sure if they did or didn’t hear back from Verizon but I’m going to say not because nothing came of the letter. Verizon continued owning their 85% of OCP.

With this tactic not working, SMP tried another one.

Letter to Shareholders

A year passes and in May 2005 the shares are now down to $21.

With still no real response from Warwick’s management or board, SMP obtained the shareholder registry and decided to write what they thought the stock was worth to all the shareholders.

They believed Warwick’s 7.5% ownership stake in the OCP partnership was worth $28.5/share - $40/share.

And the RLEC business was worth another $11/share.

This was about 100% upside from where it was trading. And STILL management refused to engage as their stock had fallen the past couple of years. The value was clearly there waiting to be unlocked but management kept putting the distributions from the fast growing wireless partnership into the declining RLEC business. Not doing anything to increase the value of the company’s stock.

There were then numerous 13D’s filed by SMP trying to embarrass the board and management. From failing to budget for Sarbanes-Oxley costs to incessant questions about how the business was going to be run for shareholders. None if it working to get management to do what they wanted

SMP tried another tactic now.

Investment Company Act

It’s now December 2005 and the stock sits at $19.

The SEC just sued National Presto for not registering as an Investment Company and won during this time because they had investment securities that represented 61% - 92% of their total assets.

National Presto now couldn’t engage in any interstate commerce or sell any securities until they registered as an Investment Company. And there could have been personal liability had the executives continued to defy the law as they were currently evading regulations when not registered properly.

I’m not an Investment Company Act expert, but from my understanding the two big tests of being an Investment Company under the Investment Company Act are:

At least 40% of the company’s assets are in securities or investments

More than 90% of the overall income is derived from the investments

Because OCP’s fair value was much greater than the value of the original RLEC business and the fact that pretty much all the pre-tax income of the entire business was generated from this investment, Warwick was potentially an Investment Company.

They even disclosed as much in their 10-K stating they might have to register and restructure as an Investment Company. It starts to make a bit more sense now why Warwick’s advisors only valued the OCP at $22.5m vs $91m for the main operating business. So they wouldn’t have to restructure.

SMP picked up on this and in 2005 filed a proxy wanting either a spin, sale, or to register Warwick as an investment company. By registering as an investment company, Warwick would have to restructure into two different companies and the investment company that’s holding the limited partnership would operate as a pass-through entity and pay out all of it’s income. This would be a huge win for SMP as they had been angling for a huge dividend increase as well.

You can apply for relief under Section 3(b)(2) of the Investment Company Act to the SEC and state you aren’t an IC but the SEC doesn’t have to necessarily grant you that relief. Warwick applied for relief and withdrew their application before the SEC even ruled.

Again, nothing ended up happening with this tactic as the SEC never made them register and SMP couldn’t get them to register themselves.

Proxy Fight

It’s April 2006 and the stock has drifted lower still to around $18. SMP finally decides to file a proxy and nominate themselves to the board as well as increase the dividend substantially. They faced an uphill battle as many shareholders were local and didn’t seem to want any change.

The partnership investment still kept growing for the most part as you can see below. But the main RLEC business was now burning cash and decreasing in value each year that passed along.

Even with the stock down more than 30% since the first 13D was filed, the other shareholders still chose to not vote for SMP’s proposals.

The Following Years

The stock continued to drift lower over time. In November 2009 it sat at $12.68 and this was the last 13D filed by SMP. They introduced a potential buyer to the company but management didn’t want to sell. Kind of unbelievable.

In 2011, Warwick purchased Alteva and changed its name.

And in 2015 it was finally bought out for $28.7m. I’m not sure if SMP still owned shares or not but it was a far cry from what they thought it should have been worth 10 years prior.

What Went Wrong

This seemed like the ideal Good Co./Bad Co. An extraordinary business that was hidden in the financial statements of a slowly dying business. There were a few problems that made this a poor investment:

Poor capital allocation - The value was clearly there, but the growing cash flows from the partnership were being reinvested into the slowly declining RLEC business. They were throwing great money after bad.

Staggered board - Only 3 directors were allowed to be elected each year. It would take a few years to at least control the board and exert some type of control.

Disengaged management and board - Because SMP only owned 2.5%, the executives and board didn’t really have to do anything they said because they didn’t control or have that large of a position. They had no urgency to increase shareholder value as they didn’t own much stock and didn’t feel threatened about potential executive turnover.

Lack of other shareholder pressure - You would think with a declining stock price that other investors would hold management accountable. But other shareholders weren’t fans of SMP and decided to vote against SMP’s ideas.

Knowing what happened after the fact, it’s easy to think I’d pass on making this investment. I’m almost certain I would’ve jumped at the chance to own such a unique asset that seemed undervalued in the market. That’s what makes investing so tough. The set up from a valuation and business stand point was extremely compelling but the capital allocation/management angle wasn’t. You typically need both to make for a great investment.

SMP summarized what happened here perfectly:

A Left For Dead OTC Stock at Less Than 1x EV/FCF

A stock with inflecting growth and margins at less than 1x EV/FCF with 93% of the market cap in cash

Summary

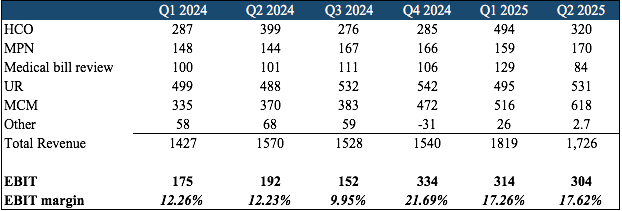

Pacific Health Care Organzaiton (PFHO) is a California workers’ compensation cost containment company that:

Trades at 0.26x 2025E EV/EBIT and 0.37x 2025E EV/FCF

In the first 6 months of 2025 they did $618K in EBIT vs an enterprise value of $929K.

No capex is required to run the business and ROIC last year was over 100%

Revenues and margins have recently started inflecting as they’ve expanded into new States

Cash makes up 93% of the market cap with no debt giving strong downside protection

Profitable since 2010

Anytime you’re offered a company at less than 1x FCF with nearly the entire market cap in cash you need to ask yourself:

Why am I so lucky?

In this instance I don’t think it’s hard to find why.

The stock has been left for dead for a number of years on the OTC market

Liquidity is abysmal at 20,000 shares in 3-month ADV, although that’s recently increased.

They’ve grown their cash balance over the past decade without doing much with it

4 large customers have left in the past 10 years

Here’s the capital structure of the company today:

What’s a Cost Containment Business?

Here’s how the business works.

All employers in California, whether it be a small company with 5 employees or the City of Los Angeles with thousands, has a work force of employees. The employer has to obtain workers compensation insurance for their employees BY LAW from either an insurance company, the state insurance fund which is kind of a last resort, they can self-insure if they are a large company or partner with a Professional Employer Organization (PEO). Once an employer decides which one, they can contact PFHO to enroll their employees and use some of PFHO’s services to help reduce their workers compensation expenses if an employee gets hurt.

Here are some of PFHO’s current clients:

A lot of their clients are not-for-profits, municipalities or corporations who typically won’t look to bring what they do in-house. There’s been some insurance clients in the past that have dropped PFHO because they wanted to bring the within their own company.

The business isn’t the greatest with zero switching costs, no real locked in contracts and no product differentiation. But there are certain elements that make it attractive like very little capex or working capital, high returns on invested capital and it’s easy to scale when on-boarding new clients. It’s comparable to a legal or accounting firm. Each year or month you bill the client for your work without having any real contract in place that they’ll come back. If a current customer wants to switch out of using PFHO, sure it’s a bit of a hassle . But if they prefer another company’s service and price they can just notify PFHO that they will be discontinuing their services.

The 5 main ways that PHCO makes money are:

HCO (Health Care Organizations - 20.5% of 2024 revs.)

PFHO offers employers the option to enroll in their HCO’s, which is a state approved managed-care system. PFHO owns 2 of the 3 licenses in California and the other one is held by Promesa Health Inc. An employer might choose to use a HCO because it allows them to control the medical treatment for first the180 days after the initial injury and thereby having some control over the cost. After this time period the employee can look else where outside the organization to help rehabilitate. HCOs differ from MPNs because they are chosen by the California Division of Workers’ Compensation, rather than by employers and their insurance providers.

MPN (Medical Provider Networks - 10.3% of revs.)

PFHO administers 22 of the 2,518 MPN’s issued by California. MPNs are usually a group of either doctors, physios or other medical/healthcare providers that accept a lower billing rate in exchange to get more volume referrals from the insurance company if it joins the MPN. The MPN is used for the life of the workers’ comp. claim. Healthcare providers in an MPN don’t need to have the necessary medical expertise when it comes to treating injuries in the workplace. Customers will choose MPNs because there are fewer costs associated with this program mainly in the form of no annual enrollment fees and less administrative costs and burden vs. enrolling in the HCO. The employer directs which provider the injured employee will see for the first visit and after that the employee can use someone else after within the network if they’d like.

HCO + MPN Hybrid

They also offer a combination of the two if an employer enrolls in the HCO and then just prior to the 180 day expiration, the employer enrolls the employee into the MPN to keep control of the medical care. Medex is the only entity in California that offers this hybrid.

Medical Bill Review (6.8% of 2024 revs.)

Someone from PFHO reviews the medical bills that are invoiced to ensure that bills are reasonable and compliant and nothing nefarious is taking place. PFHO receives a fee for each medical bill that’s reviewed and a percentage of savings off the hospital bill.

Utilization Review (33% of 2024 revs.)

UR is required by law for workers compensation claims. Someone, a nurse or medical director, will compare the treatment plan against the medical guidelines for the injury. It helps avoid potential excessive costs that a medical provider might include.

Medical Case Management (25.7% of 2024 revs.)

Essentially someone that oversees the entire injury process and ensures everything runs smoothly. Each medical case manager (i.e. nurse) coordinates between the employee, medical practioners, claims adjuster, etc to ensure the injured employee returns to work as soon as possible and is on track to healing and closing the claim.

Industry/Competitive Dynamics

The reason the workers cost containment industry exists is because there are potentially two sides of fraud that can occur when dealing with workers’ compensation claims: from the employees on one side and from medical professionals/lawyers on the other. Employees may embellish or lie about their injuries to get more money or not have to work while collecting workers’ compensation. Doctors or lawyers can collude with the worker to exaggerate a claim, over treat or over prescribe. This would cause increased costs for the the claim and the entire system. Just in 2024 alone potential fraud loss that was detected and saved was $157m, so clearly the industry is needed.

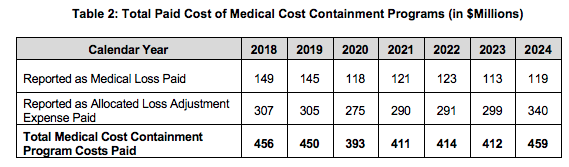

Getting industry data for the industry in California has been tricky but here’s what I’ve been able to find:

Two of the largest cost drivers for dealing with workers’ compensation claims are claims frequency and treatment duration.

California has the longest workers comp. claims open after 60 months when compared with other states. More than 3x the states median according to the Workers’ Compensation Insurance Rating Bureau of California (WCIRB) 2025 State of the System. Longer claims open leads to higher costs as you’d expect.

In 2024, insurers collected $15.5B in workers’ comp. premiums earned and paid in total losses and medical expenses $16.7B. Within that $16.7B, $459m went to medical cost containment costs paid and the total cost amount has been pretty stable the past few years. If you want more of a breakdown of these costs you can read it here.